Our top ideas for the coming year. Our family office has a position in all the below.

Golar LNG

Golar LNG Limited

- Golar LNG builds, owns, and operates marine infrastructure for LNG liquefaction and regasification, with a market cap of $2.3 billion.

- Golar’s assets include FLNG vessels currently working for Perenco, with the potential for new contracts that could double EBITDA.

- The arrival of FLNG Gimi to the BP offshore field and its operation in late 2024 will increase Golar’s EBITDA by 50% and potentially result in a dividend hike.

- The Investment case is supported by dividends and a USD150 million buyback.

- Strong catalysts in the next six months.

- The new contract for GLNG’s largest liquefaction vessel, Hili, will be a major catalyst for the stock – it has the potential to double the current EBITDA. The announcement is expected in the next six months.

- The arrival of GLNG´s second liquefaction vessel, Gimi, to the BP offshore field – is expected in January 2024.

- The commissioning of Gimi is expected to be in the first half of 2024. During the commissioning, GLNG will start earning revenues from BP

- Operation of Gimi – expected late 2024

- Refinancing of Gimi debt – expected after Gimi operation.

- Increase of dividends/buybacks – the operation of Gimi should result in a dividend hike. Currently, Golar pays USD 1 per share. Consensus assumes a 100% dividend hike to USD 2.

- Conversion of FLNG Fuji – the ship will be delivered to Golar in early 2024. Further details on its FLNG conversion timing and potential contracts would be very value-creative.

- Sale of Golar LNG.

For the full investment idea summary, go:

Africa Oil

- Africa Oil owns a 6% stake in the Venus discovery, the 8th largest discovery made in the 21st century.

- TotalEnergies is the largest investor and operator of Venus. Total calls Venus “Golden Block”. Total is spending 50% of its global exploration budget on Venus.

- Retail investors speculated on Venus’s size disclosure during Total’s Capital Market Day through Africa Oil shares, causing a 30% drop in its share price. That made the opportunity more attractive.

- The second Venus well results are expected to be published by the end of November. That should further certify Venus’s size and push the Africa Oil stock up.

Africa oil At 19 SEK/sh, the Venus discovery/ Namibia exposure either is not reflected in the share price at all, or ii) Venus is reflected, but AOI’s production in Nigeria is valued at EV/GAV ~0.3x.

Either way, we find the 19 SEK/sh entry point in AOI to be highly attractive. Total has drilled two wells on Venus. Results for both will most likely be communicated in connection with TotalEnergies Q4 results February 7th).

Vicore Pharma

If Vicore were a US-listed company, its valuation would be multiple times higher. The best proof is Pliant, a company in a similar state of development with much worse drug results. Vicore hired a new Boston-based CEO whose claim is to connect Vicore to a US investor base. Just before the year’s end, Vicore also hired a new Chief Medical Officer with experience in respiratory medicine from AstraZeneca and Galecto. Just connecting the story to US investors should strengthen the share price materially. Top US professional pharma investors have already entered the last capital raise. This should continue in 2024.

For the full investment idea summary, go:

Biovica

- In cancer treatment – the speed of cancer monitoring drives survival. Biovica breast cancer tests can quickly detect whether the selected medication is working.

- Biovica biomarker breast cancer test can detect cancer progression at least 60 days earlier than imaging. And 3-10 times cheaper.

- Bloomberg just reported, “Biomarkers are Dramatically Changing Cancer treatment”. Biovica was the first-ever FDA-approved Biomarker test for cancer. It has the potential to be one of the market leaders.

- Very strong clinical data – 28 studies including from the most prominent US hospitals (Mayo Clinic, John Hopkins, the Dana-Farber Cancer Institute).

- Market potential > $2 billion for monitoring of metastatic cancer.

Linkfire

Linkfire presents a unique Private Equity deal opportunity.

Linkfire was listed in 2021 at 7 times higher capitalisation than it is today. The company is due to be delisted on 14 January 2023. After delisting, the company will start the process of selling itself to a strategic partner. The founder and CEO resigned from their positions to focus on the sale of the company. If this succeeds, it is a multiple-times opportunity.

Norsk Titanium

- Pioneer in titanium parts printing.

- Titanium printing consumes up to 80% less titanium in the production of parts for aviation and defence. Being first in the field is an opportunity and risk:

- Aviation is a highly regulated industry – to break through the licensing takes a long time.

- Once this is achieved, the opportunity is very material – Norsk Titanium can disrupt traditional titanium producers.

- Over USD400 million invested in technology

- USD90 million market capitalization

- No material debt

- 170 patents

- 100+ employees

- 35 machines with 700 tons capacity

- USD300 million annual revenue capacity

- Revenue guidance for 2024 of USD25 million

Energy Recovery

- ERII is one of very few highly profitable renewable companies.

- ERII has a $1 billion market cap, zero debt, $100 million in cash, 72% margins, and 20% revenue CAGR.

- Energy Recovery dominates the global industrial desalination industry, having a 90% global market share.

- ERII is now trying to copy its technology into a new global segment – industrial air-conditioning and refrigeration.

- Due to Kigali protocol, all greenhouse gas industrial air-conditioning and refrigeration systems need to be replaced with CO2 systems.

- Energy Recovery devices can save up to 40% of energy in the new CO2 devices. ERII has a 25-year track record and no major competition.

- Next year will be the year of transformation for its industrial air-conditioning and refrigeration products. ERII guides it to install the product in 50 locations this year. This should cause major revenue updates for the coming years.

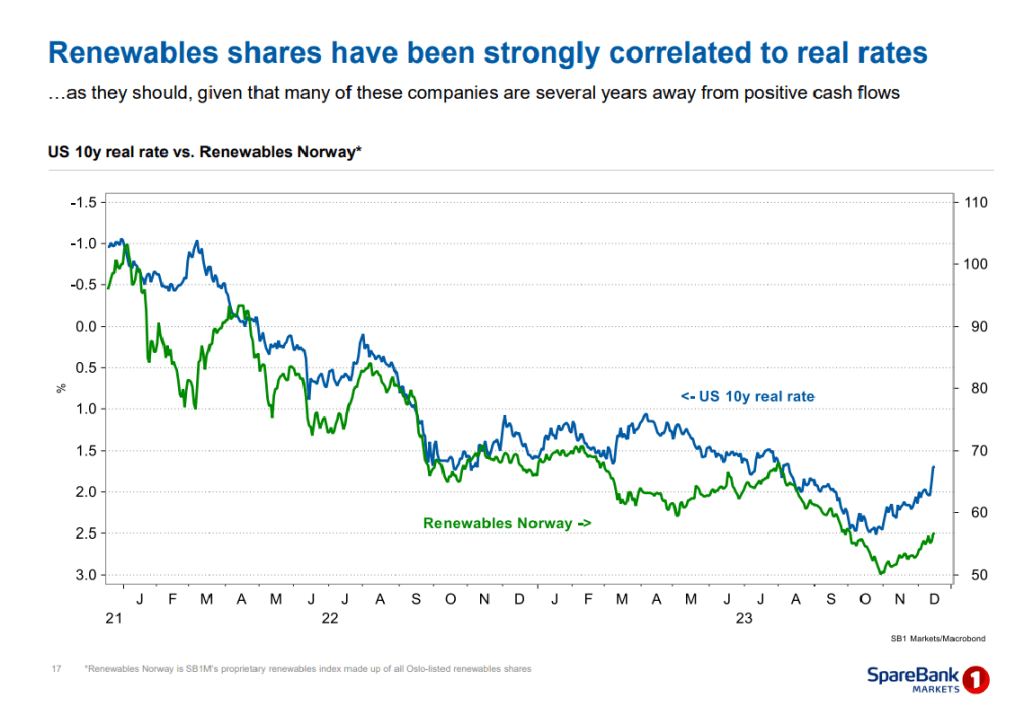

Declining interest rates should boost renewables

Renewables trade like growth stocks. Both are very sensitive to interest rates. SpareBank published a very nice illustration.

The graph illustrates how renewable stocks have been hammered by raising rates. The graph also shows that the yields have been reversing from the November FED pivot, as has the renewable index. So, if you believe the rates have peaked, you should look at renewables.

Disclosure:

The goal of the blog is to provide investment ideas for further research. I/we have a beneficial position in the shares discussed above either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. The article does not represent investment advice. Please do your own research before making any investment action.