On December 6, 2023, we published our Golar LNG idea here. We predicted several catalysts that should drive the stock up significantly. The rumours related to one of the catalysts drove the share price up 10% yesterday. An indication of upside potential.

Summary from our original post

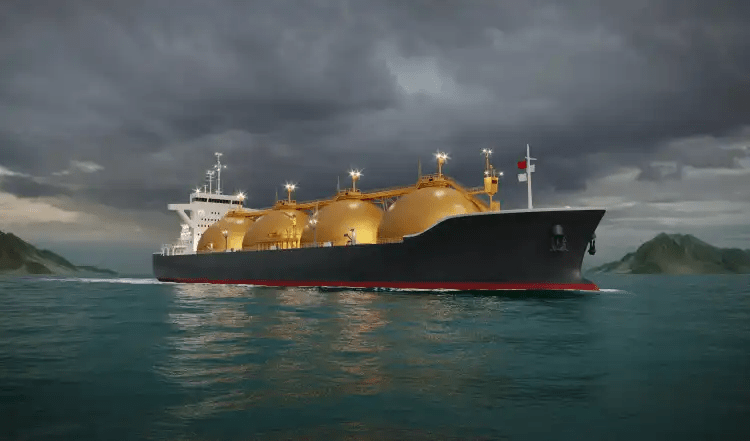

- Golar LNG builds, owns, and operates marine infrastructure for LNG liquefaction and regasification, with a market cap of $2.3 billion.

- Golar’s assets include two FLNG vessels.

- The first vessel, Hilli, is currently working for Perenco. The contract ends in 3q26. The new 10-year or longer contract would be a major catalyst for the stock.

- Hilli is currently working on a 1.4mtpa contract vs. her capacity of 2.4mtpa. If the new contract is for the full capacity, the EBITDA could increase by 70%.

- The second vessel, FLNG Gimi, arrived in January at the BP offshore field. Its operation in late 2024 will increase Golar’s EBITDA by 50% and potentially result in a dividend hike.

- Strong catalysts in the next six months.

- The investment case is supported by dividends and a USD150 million buyback.

Link to the investment idea:

What happened yesterday

Our idea is starting to play out – Hilli is rumoured to be in contention to service YPF off Argentina, driving to GLNG 10% up yesterday.

There has been some chatter/rumours regarding FLNG Hilli, which may see her go work for YPF off Argentina after her contract for Perenco in Cameroon is finished in 3q26. The new contract will be the major catalyst for the stock, as yesterday’s share price reaction indicated.

YPF stated in their 4q23 earnings press that they want an external FLNG for 1-2mtpa from 2027, fitting well into the expiry of Hilli’s current contract. That fits well for Hilli.

Hilli is currently working on 1.4mtpa contract vs. her capacity of 2.4mtpa. Argentina rumours fit well (also fits well with GLNG mgmt. comments on the 4q23 earnings call regarding Hilli not being relevant for further Africa work at this time).

If this is correct, it helps de-risk the Hilli-case and provide visibility and long-sought for news flow. Gimi, GLNG´s second FLNG vessel, is set to commence commissioning in the coming months.

Once Gimi is operational, we believe the fixed quarterly dividend will rise and that parts of the net proceeds from the Gimi refi will be paid out as dividends.

The story is starting to play out, as predicted. Stay tuned for more.

Disclosure:

The goal of the blog is to provide investment ideas for further research. I/we have a beneficial position in the shares discussed above either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. The article does not represent investment advice. Please do your own research before making any investment action.