The article is copied from http://www.hedgefundalpha.com/norsk-titanium-disrupting-aerospace/

The article was also published on Microsoft Network NSM:

Summary

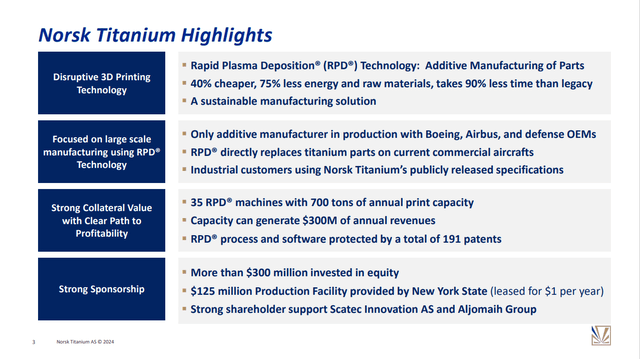

- Norsk Titanium is the global leader in Rapid Plasma manufacturing of titanium parts for aerospace, defense, and chip industries.

- The company has invested $425 million in its proprietary Rapid Plasma Deposition technology, which reduces material and energy costs by 75% versus currently used production methods.

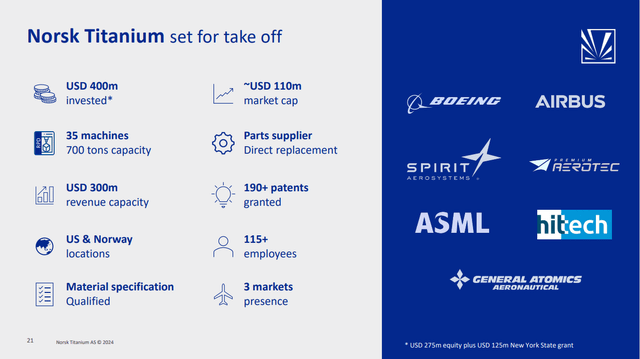

- Norsk Titanium has partnerships and contracts with Airbus, Boeing, Northrop Grumman, and other major aerospace and defense companies.

- Exponential revenue growth should multiply the stock price over the coming two years.

Norsk Titanium (OSE: NTI) and (OTCQX: NORSF) s the global leader in additive manufacturing (3D printing) of Titanium parts for the aerospace, defence, and chip industries. Their business involves producing aerospace-grade titanium components using a proprietary process called Rapid Plasma Deposition (RPD).

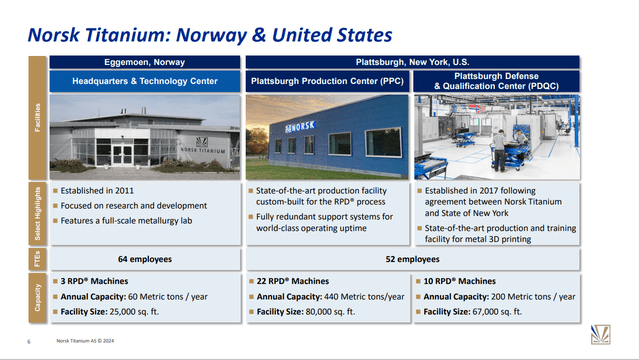

Norsk Titanium’s main production is in New York State, and its research centre is in Norway. The company is listed on the Oslo Stock Exchange with an NTI ticker and in the US with NORSF ticker. A US listing is on the cards possibly for the next year. The Company has a USD 140 million market capitalization and no debt.

Norsk Titanium invested USD 425 million into its technology – USD 300 million of shareholders’ capital and USD 125 million of grants from New York State. The company has 191 patents for its technology.

Norsk Titanium has 35 RPD machines with 700 tons of annual production capacity, which can generate USD 300 million at full capacity. The company has 115 employees in its two locations.

Technology

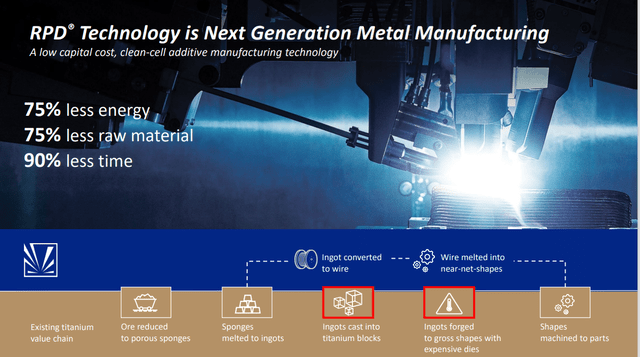

Norsk Titanium’s proprietary RPD technology enables the company to produce high-quality, complex titanium parts with significant cost and time savings compared to traditional manufacturing methods. The technology consumes 75% less energy, 75% less raw materials and 90% less time vs mainstream manufacturing techniques.

RPD technology allows them to compete effectively in the aerospace industry, where titanium components are crucial but traditionally expensive.

RPD is a disruptive technology

Norsk Titanium’s RPD technology is a disrupting technology that should disrupt current producers. RDS gives them a competitive edge over other manufacturing methods. Their process reduces material waste, production time, and costs, making them an attractive option for aerospace companies looking to streamline their supply chain and reduce production costs.

We believe RPD is the disruptive technology that will replace the current production methods. Norsk Titanium is the global leader and will most likely capitalize on this trend.

Focused on Aerospace, Defence, and Commercial

Norsk Titanium is concentrating on three revenue-generating areas. The biggest opportunity is the Aerospace industry, where regulation and licensing, which take many years, limit competition and, therefore, allow for better pricing.

Aerospace – Norsk Protected by Regulatory Barriers to Entry

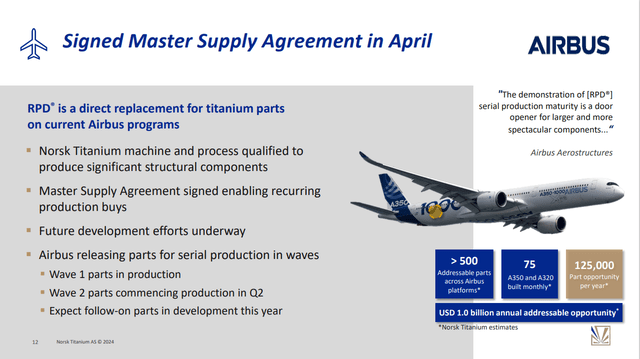

The major barrier to entry is Norsk Titanium’s partnerships and contracts with the major aerospace companies. These partnerships validate the company’s technology. Aerospace is a highly regulated industry. It took Norsk Titanium over seven years to sign the Master Supply Agreement with Airbus. That milestone was achieved in April, resulting in a series of Airbus production orders.

Similarly, in April, Norsk announced it had signed a Production Agreement with Boeing. The agreement started a direct supplier relationship between the companies, enabling Norsk Titanium to be a tier-1 supplier to the Boeing procurement system.

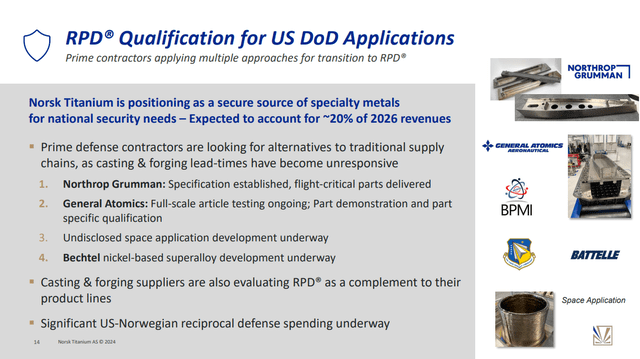

Strong Position in Defense

It took several years for Norsk Titanium to obtain all qualifications for the Department of Defense.

The most advanced is the cooperation with Northrop Gruman, where flight-critical parts were already delivered by Norsk Titanium. Production of parts for General Atomics, and others is underway. For Bechtel Norsk Titanium is developing a whole new nickel-based material, which is a big step forward for the company’s offering.

Norsk Titanium got a material rubber stamp of support from Northrop Grumman that presented an overview of how they apply the Norsk Titanium process to flight critical components at this year’s 2024 National Conference for Additive Manufacturing in Hammerfest, Norway. Their presentation was an impressive vote of confidence from Northrop.

A similar vote of confidence was voiced by General Atomics

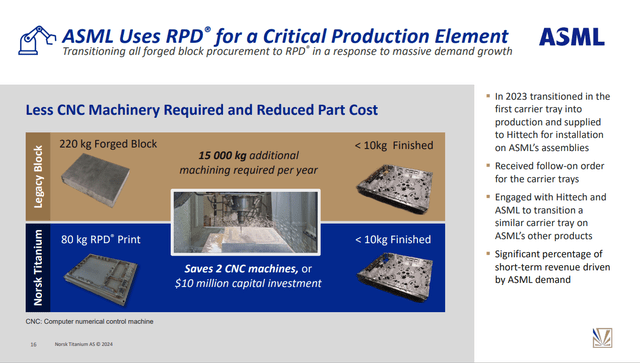

Big Opportunity in Commercial Production

Norsk Titanium supplies Titanium components to ASML Holding, a Dutch company and one of the world’s leading suppliers of photolithography systems used in the semiconductor manufacturing industry. Norsk Titanium’s relationship with ASML is through ASML’s tier-one supply chain partner, Hittech. Norsk expects to double its sales to ASML this year.

Strong Revenue Growth in the Coming Years

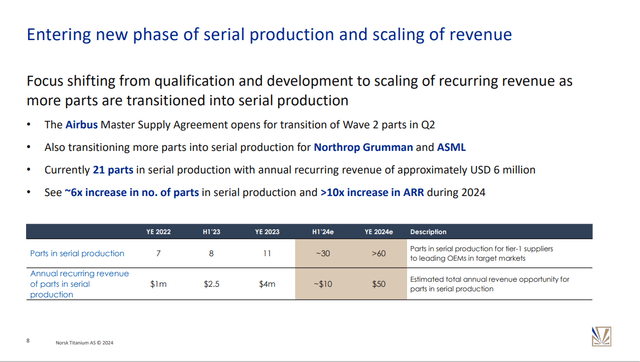

The new contracts with Airbus and Boeing, significant milestones for Norsk, have paved the way for substantial revenue growth.

- At the end of 2023, Norsk was producing 11 parts for different customers (each part may be made in hundreds or thousands of pieces)

- At the end of April, the number has increased to 21 parts and

- by the end of 1H24, Norsk expects to have 30 parts in production.

Based on the contractual negotiations, Norsk is guided to have more than 60 parts in production by the end of the year.

The recurring revenues would increase from USD 4 million at the end of 2023 to USD 10 million at 1H24 to USD 50 million at the end of 2024.

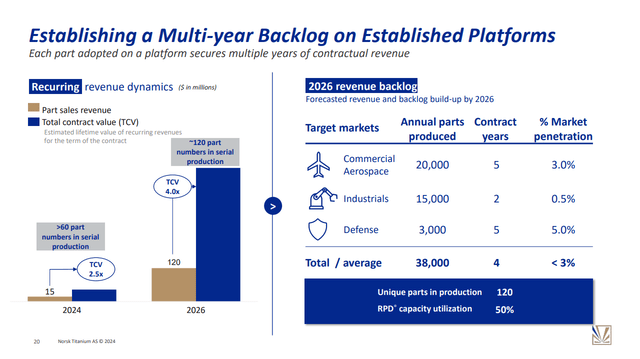

Based on its relationship with Airbus and Boing, Norsk is guiding to be producing over 120 parts in 2026 and expects recurring revenues to reach USD 150 million in that year.

Valuation

Norsk Titanium’s market capitalization is currently around USD 140 million. That is just one-third of the USD 425 million (USD 300 million in equity and USD 125 million in grants from NY state) invested in the technology. The reason for the discrepancy is in the length of the certification process. The Airbus contract took so long that many investors lost their patience and drove the share price down. That created this opportunity.

Valuation of Norsk Titanium when producing at full capacity in 2028

Assuming revenues of USD 300 million and an EBITDA margin of 30%, you get an EBITDA of 90 million. At that stage, the company would be trading at least 10 times the EV/EBITDA multiple. As Norsk has no debt and is fully funded to break even, the company should be valued at at least USD 900 million—6.5 times its current market capitalization.

Norsk Titanium valuation based on its 2026 USD 150 million revenue guidance:

- Revenue guidance for 2026: USD 150 million

- EBITDA margin guidance in 2026: 30%

- EBITDA in 2026: USD 45 million

- Assumed debt in 2026: 0

- Assumed EV/EBITDA multiple: 10

- Enterprise value in 2026: USD 450 million

- Current Capitalization: USD 140 million

- Upside: 320%

- Current share price: 2.7 NOK

- Target share price: 8.7 NOK

The above does not consider the issued warrants, which can be converted into shares later this year. The warrants do not change the upside picture materially.

A material part of this upside should be realized this year.

Conclusion

Many investors lost patience with Norsk Titanium due to the long wait for Airbus and other certifications and contracts. This created the opportunity. The agreements with Airbus and Boing have been signed; the orders are piling in, andthe story has been de-risked. Investors are returning, and the share price has a good momentum. The share price has increased, but there is still a three-time potential to reach 2026 targets. We should see a substantial price rerating this year.

Link to the April Capital Markets Day presentation:

Disclosure:

The goal of the blog is to provide investment ideas for further research. I/we have a beneficial position in the shares discussed above either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. The article does not represent investment advice. Please do your own research before making any investment action.