Last week, we spoke to the company, analysts and South Africa insiders. Below is my understanding of where Africa Energy stands.

On Monday, Africa Energy announced that its partner in Block 11B/12B, CNR, intends to withdraw from the block and that the block operator, TotalEnergies, is considering its options. The Africa Energy share price reacted by dropping 75% on large trading volume. Investors are speculating that TotalEnergies will also withdraw after a Bloomberg article quoted a PetroSA source saying that TotalEnergies had already notified the government of its intention to withdraw.

Over the last two years, the South African government has failed in the energy sector with rolling blackouts and very little progress on offshore oil and gas exploration, especially compared to Namibia next-door. The South African Energy Minister Mantashe (recently reappointed) has been promoting the gas transition publicly, but he is clearly in bed with the coal lobby and has made no progress with oil and gas, even getting tied up in court with Shell and Impact over foreign-funded environmental protests to offshore exploration. Moreover, the President has still not signed the energy bill that was approved by the parliament several weeks ago and has been promised for about a decade. Finally, TotalEnergie’s application for the Production Right for Block 11B/12B, filed more than two years ago, has still not been granted, delayed by TotalEnergie’s concerns about protests on its environmental impact assessment, now due August 30. CNR clearly lost patience, and the asset was never really core to their mainly Canadian oil business. But is it core to TotalEnergies?

There are positive signs — the new Democratic Alliance (DA) coalition government should be more friendly to business and encourage foreign investment. But mainly the Minister of Electricity role now also includes Energy taken away from Mantashe, who retains Mining and Petroleum. Taking away Energy from Mantashe, might be quite positive. So reason may prevail to help the Block 11B/12B project.

I think it can play-out in two ways:

1. TotalEnergies is bluffing and remains operator of the block with all the noise about withdrawing just a negotiating tactic to put pressure on the new South African Government to finalise the gas off-take agreement and approve the Production Right; or

2. Everybody withdraws from Block 11B/12B except Africa Energy / Main Street, which will get 100% of the block for free. AEC’s largest shareholder is now Impact, which is controlled by Johnny Copeland, a white South African billionaire who is a former member of Parliament and now CEO of HCI, a black-empowered South African business conglomerate focused on hotels and casinos. He is very well-connected in SA and is the best placed to execute the project long-term. I guess this is why the Lundin family passed the baton to him and stepped away from AEC. It may take a bit longer than expected, but sources say Copeland sees Block 11B/12B as a patriotic mission to supply South Africa with much-needed domestic gas. A 100%-stake in Block 11B/12B should motivate him to achieve this.

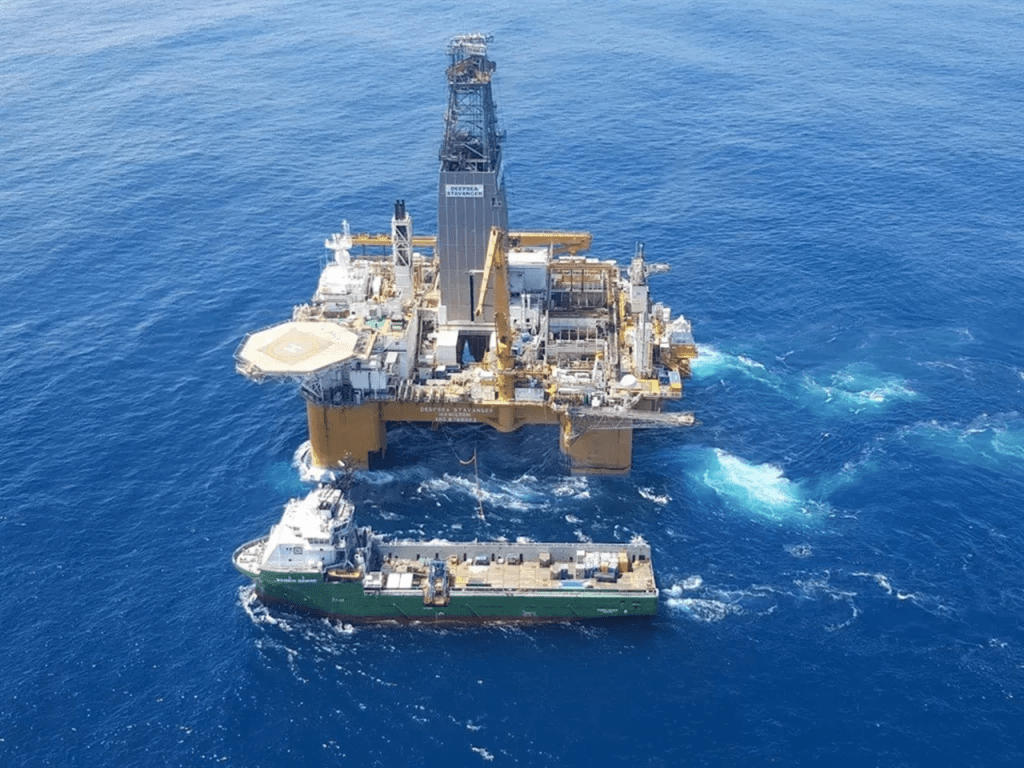

At the moment, I believe option 1 is more likely. TotalEnergies declared last week to the South African government that they are in fact staying in Block 11B/12B, no doubt to buy government goodwill for their efforts to explore for oil off the West Coast of South Africa. They plan to drill soon in the offshore South African blocks on trend with their large discoveries offshore Namibia in the Orange Basin where Impact (Johnny Copelyn) is their partner.

In the article published yesterday, Thulebona Nxumalo, an official at the National Energy Regulator of South Africa is quoted:

“We contacted them (TotalEnergies) to try and get clarification about what is it that is happening there. And what they indicated is that they had initially planned to exit but following engagements that they’ve had with government and other stakeholders, they’ve decided to stay. So, it sounds like they will be staying for now on that Brulpadda project,”

Source: https://headtopics.com/za/offshore-gas-finds-nersa-says-totalenergies-staying-for-55383421

Furhter, see the PGS meeting link below and listen from time stamp 1:05. The Minister says TotalEnergies confirmed that they are staying. http://www.youtube.com/live/ZLvQRysCLnw?si=CFeUCPjvURL8svDJ

Of course, this is a statement that may change in the future.

In summary, we believe the AEC investment is not lost. We think the Block 11B/12B gas development will happen. There is a lot of gas there, and South Africa clearly needs the gas. If TotalEnergies stays, it will happen faster. If they do not, it will take more time, but it could happen with more upside for AEC shareholders under Johnny Copelyn’s lead.

The risk I see is Russian involvement. If Gazprombank invests in the nearby Block 9 infrastructure with PetroSA, no one will be able to use it because of US sanctions. I have no information that this is what is happening, but it is a risk. Last year, Gazprombank won a tender for financing the reconstruction of the Mossel Bay gas-to-liquids plant, which is now shut-down due to lack of gas feedstock from the depleted Block 9 offshore fields. The tender was widely criticised and based on suspicious conditions whereby all other bidders were eliminated (see our previous blog post on this). After public criticism, the tender went quiet, and it could be cancelled under the new coalition government. The final investment decision was due by April, but nothing has been announced.

Conclusion

The best case in terms of timing is that TotalEnergies stays, gets the Production Right by the end of the year, and the whole project moves forward. Africa Energy is a great investment in that scenario, especially at today’s depressed share price and with all its funding secured from shareholder loans. If it goes back to 3 SEK, where it was trading when the Production Right application was filed, you are looking at 15 times return!

The alternative is that South Africa continues to stall the gas price negotiation or Gazprombank stays involved in the block next-door, forcing a more expensive development that cannot rely on the Block 9 infrastructure. That would result in everybody withdrawing except Africa Energy/Main Street, which would control 100% of the block for free. In that situation, we still believe that the project will happen, but it will take longer.

We have been buying Africa Energy stock last week.

Disclosure:

The goal of the blog is to provide investment ideas for further research. I/we have a beneficial position in the shares discussed above either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. The article does not represent investment advice. Please do your own research before making any investment action.

1 Comment