Copied from SeekingAlpha.com

Summary

- This is last week’s second instalment from the London Institutional Investor Growth Stock Conference.

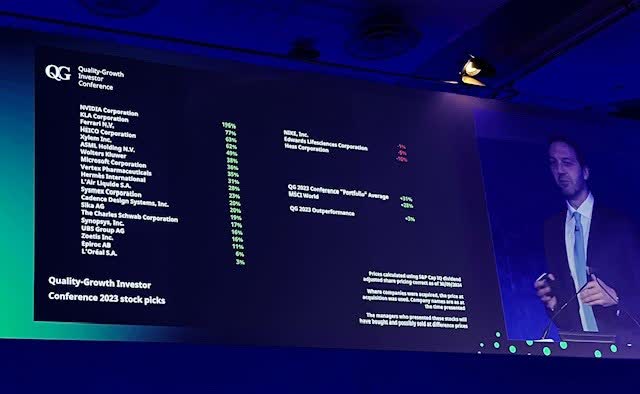

- Ideas from last year’s conference generated very substantial returns of up to 196%.

- The first article focused on hedge fund presentations at the conference. This second article provides a brief summary of ideas we heard during the networking conference.

- Conferences are about investment idea generation. We share the ideas in our two articles.

The third year of the Quality Growth Investor Conference brought interesting investment ideas and several investment conceptual concepts.

Around 200 institutional investors attended the presentation. The ideas from last year’s conference generated very substantial returns. I recommend reviewing the ideas in my first article.

Ideas from last year’s conference generated substantial returns.

In our previous article, we included summaries of individual presentations by each asset manager. In this second and final installment from the conference, we briefly summarize the most interesting ideas from the networking during and after the conference. We present the reasoning given at the meetings. For a detailed analysis of the below ideas, you can search Seeking Alpha.

Talking to fellow investors generates equally interesting investment ideas as the conference itself. That is why we found the conferences valuable.

Best Ideas From Post-Conference Networking

Meta (META)- formerly Facebook,

is the most interesting AI play for the second round of the AI revolution

- Meta has ~1.5 trillion USD market capitalization.

- Meta operates the following platforms: Facebook, Messenger, WhatsApp, Instagram, and Meta Horizons.

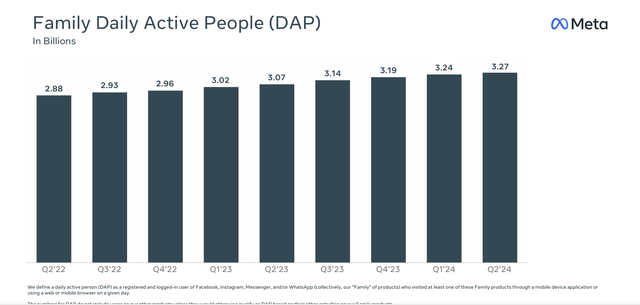

- Over 3.3 billion people around the globe are using Meta products on a daily basis. The number is increasing.

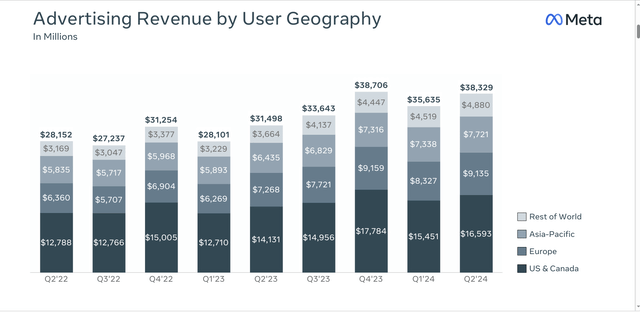

- Meta is an advertising business; more than 99% of its revenues are from advertising.

- Quarterly advertising revenues are around 38 billion USD

- Meta collects information through all its platforms on all of our daily activities.

- Nobody knows about us so much as Meta does.

- These collected data can be and will be used for targeted AI advertising.

- Meta is the best positioned for this AI revolution in advertising.

- Meta invests heavily; over the last two years, its capital expenditures have doubled from 8 billion USD to 15 billion USD.

- Based on historical experience with disrupting technologies, the biggest winners of AI will be different companies that are today’s winners.

- Facebook is the prime candidate for growing its advertising revenues above its peers because Facebook knows more about us than its peers.

- It isn’t easy to quantify potential Facebook growth. The quarterly revenues have not grown much recently, and Facebook still trades at a valuation of 1. 5 billion USD.

- The valuation is around ten times its current revenues. Anybody can do a back-of-the-envelope calculation, and the value creation can be massive.

- The presenters argued that we would see a 10 trillion stock within five years. Meta will be the prime contender in that race.

Click to Enlarge

Energy Recovery (ERII)

has a US-based market capitalization of around one billion USD. ERII is one of the few ESG companies that makes money.

- ERII expects 2024 revenues to exceed 150 million USD. It has gross margins above 70%, no debt, and over 100 million USD in cash. ERII is profitable and cash-generating.

- ERII is focused on desalination. Its technology saves around 60% of the energy consumed by desalination plants.

- ERII dominates desalination. Its technology has a 98% global market share in large desalination plants. The company has not lost a project in seven years.

- Now, ERII is starting to implement the same technology in other industries.

- The first was wastewater processing. The business is growing by over 100% per year.

- The next is industrial air conditioning and refrigeration. All developed countries signed up to replace existing systems that run on greenhouse gases with other, mostly CO2 systems. Those systems run at higher pressures and, therefore, need more energy. ERII technology can save 30% of energy costs in those systems. Tens of systems are now installed in supermarkets globally for customers to try.

- This segment can potentially change ERII’s fortunes in the coming years and multiply its revenues over the next five years.

- We found an article today that indicates ERII is already working with several large refrigeration and airconditioning producers to implement ERII´s technology into their system. https://naturalrefrigerants.com/chillventa-2024-energy-recoverys-px-g1300-to-be-integrated-into-new-co2-racks-by-leading-oems/

- See below the latest investment presentation by ERII from their website:

Click to Enlarge

Dynagas LNG (DLNG)

is an LNG tanker company listed in the US with a market capitalization of 150 million USD.

- The company operates six LNG carriers.

- The company’s vessels have locked into long-term contracts with an average remaining contract period of 6.4 years.

- The total contractual backlog is over 1 billion USD.

- DLNG has paid out debt significantly. Current debt to EBITDA is below 3x.

- On the last call, the company announced that it would announce its capital allocation strategy on the next call – see the last slide of the presentation.

- DLNG will most likely announce dividends. The company can pay 0.75 USD per share, compared to its current share price of 3.8 USD.

- If they paid 100% of what they could pay, this would represent a 20% dividend yield.

- Stocks that start paying dividends to outperform. DLNG should be an excellent example of this.

- See below the latest investment presentation by DLNG from their website:

Click to Enlarge

Electro Optic Systems (OTCPK:EOPSF) (“EOS”)

is an Australian defence company that is a global leader in drone defence. Its marketing logo is “Nobody kills drones like EOS.” In Australia, it has a market capitalization of USD 250 million.

- War Ukraine has shown how drones have become the New weapon for all future wars.

- EOS is the leader in shooting down drones with bullets and lasers.

- Shooting drones with Bullets and Lasers is much cheaper than shooting them with rackets. The racket costs 100,000 USD, and the bullet costs about 100 USD.

- It is listed in Australia, where investors are not exposed to the daily news on drone fighting and do not appreciate it.

- The company is run by a respected industry veteran who was the head of Rheinmetall’s defence business and brought several Rheinmetall colleagues with him.

- EOS is a former spinoff of the Australian Laser Institute. Australia spent 1 billion USD developing lasers for defence purposes.

- EOS has production facilities in the US, the Middle East, and Australia and is now looking for a European production site.

- EOS trades at 50% discount to European peers on Price to backlog basis.

- EOS is growing strongly, generating cash, net cash positive and selling globally.

- See below the latest investment presentation by EOS from their website:

Click to Enlarge

Norsk Titanium (OTCQX:NORSF) (“NTI”)

is a global pioneer in the 3D printing of titanium and other precious metals, mainly for the aviation industry.

- Based in the US, listed in Norway

- Got over 150 million USD in subsidy from New York state

- In total, 450 million of capital and subsidies were invested

- Its patented technology consumes 75% less energy, 75% less material and 90% less time.

- Aviation certifications took seven years, and investors lost patience

- Airbus certification was done this year, and the number of parts produced for Airbus doubles quarterly.

- Primary customers are Airbus, Boeing, ASML, Northrop Grumman

- At the end of the year 23, NTI was producing 11 parts. By midyear, that number had increased to 26. The most significant part is over 6 feet long.

- Very high-growth potential.

- If the growth targets are met, there is multiple times upside potential.

- See below the latest investment presentation by NTI from their website:

Disclosure:

The goal of the blog is to provide investment ideas for further research. I/we have a beneficial position in the shares discussed above either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. The article does not represent investment advice. Please do your own research before making any investment action.