Copied from SeekingAlpha

Summary

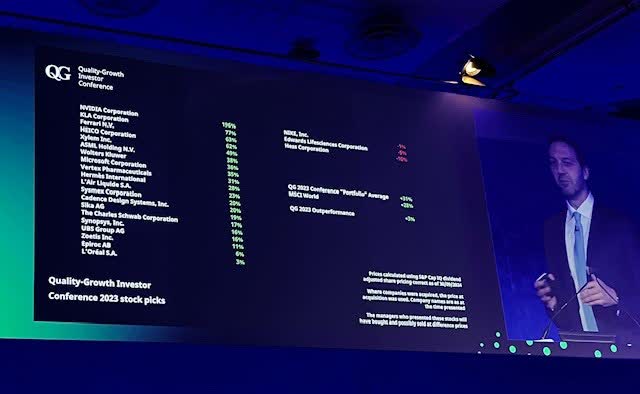

- Nvidia was one of the top picks at last year’s conference, and it generated returns of 196%.

- This article summarizes ideas from this year’s conference.

- Key investment themes include focusing on large growth compounders, investing in disruptive consumer stocks, and prioritizing quality technology companies with sustainable competitive advantages.

The third year of the Quality Growth Investor Conference brought interesting investment ideas and several investment conceptual concepts.

Most Interesting Big Picture Points

The speakers argued that it is less risky to financially succeed with a large company investment than a small, promising company. Out of 800 small companies in the UK at the start of the century, only three succeeded in becoming UK large caps, while 600 have left the index. Several speakers stressed this theme. James Anderson, one of the UK’s most prominent investors, argued that 70 companies have accounted for most global value creation since 1995, and the concentration of value creation is increasing.

Presenters illustrated that investors want growth companies to reinvest profits. Growth companies that pay dividends tend to underperform significantly.

Finally, the presenters argued that trading around your positions can generate superior returns compared to general buy-and-hold strategies. Increasing positions on weakness and decreasing on strength generates substantially higher returns than traditional buy-and-hold strategies.

The conference, as well as post-conference networking, generated several exciting ideas. We share those below.

The companies recommended at last year’s conference achieved significant value creation. Nividia led with 196%, while almost all companies achieved double-digit share price growth.

Best-performing stocks presented at last year’s conference.

Individual Presentations

Each of the presenters had 20-minute short presentations. The summary of the most interesting ones is below:

Nick Train of Lindsel Train

In the UK, Equities focuses on large growth commodities.

Train is a Lindsel Train co-founder who has managed global portfolios for over 40 years. In his presentation, he raised the main points:

- UK equities have underperformed major markets since 2000

- Some UK-listed global winners will drive the UK market in the future

- Reasons for UK underperformance are mainly a strong 15% weighting of underperforming Telecom companies and a shrinking share of UK tech companies.

- ARM and Sage are symbolic of UK underperformance

-

- ARM is growing strongly, but listed in the US – ARM would be 5% of the UK index if listed there

- Sage – for decades, has been forced by the market to pay high dividends – after they stopped and started reinvesting into growth – the share price started to over-perform

- Investors want growth from tech – not dividends. Dividend-paying tech underperforms

- Only a few small companies become relevant – over 25 years, only three UK companies from the index have become large companies, while 611 small companies out of 800 left the index

- Large companies that can compound strong growth are the less risky winners.

- AstraZeneca – the largest company on the index, now has appreciated five times over the period – its weighting in the index tripled.

- London Stock Exchange – grew 24 times – its weighting doubled from 1% to 2%

- Relex – moved from the 60th largest to 6th – appreciated 7 times

- Rightmove – from 500th to 80th – leading digitalization of the UK property market – appreciated 17 times

- We are bullish on UK companies – US investors are pushing the strong performers to grow even stronger

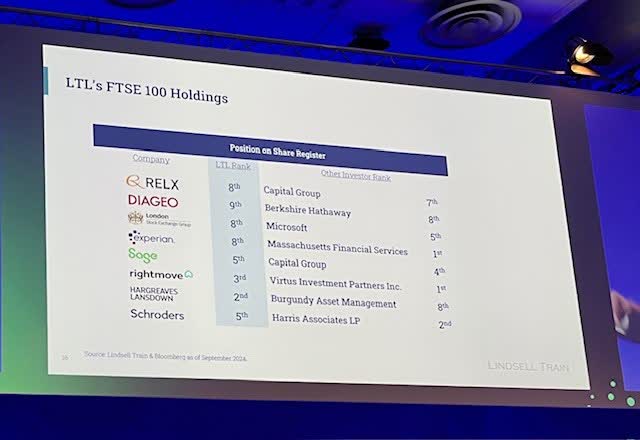

- Investors should focus on large companies and focus on companies that have strong global investors as they push for performance – PICTURE

- Our favourite is London Stock Exchange – it has a lot of optionalities to continue growing strongly

- Train presented a slide with his UK favourite stocks

-

Rebecca Irwin of Jennison Associates

How to invest in disruption

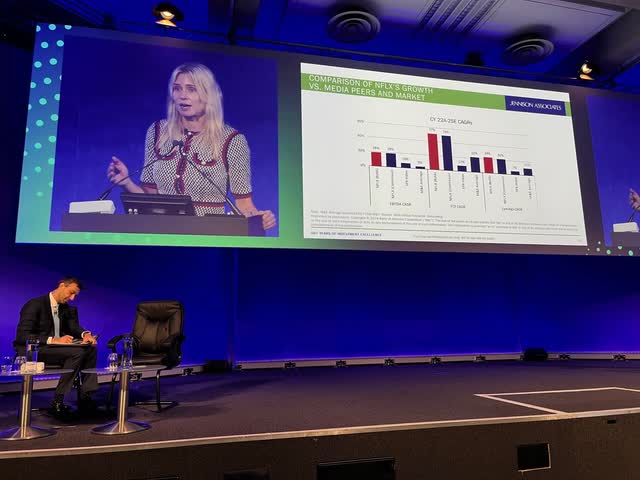

Global asset manager Jennison Associates, founded in 1969, has $200 billion under management. Irwin has been a portfolio manager at Jenninson for almost two decades, focusing on consumer stocks. In her presentation, she focused on their investment principles and her two favourite positions.

- We like consumer stocks; they are two-thirds of global economies

- We look for companies with four characteristics

– Our companies must satisfy the below criteria

-

- Large addressable market – only scale can grow durability of growth

- Consumer acceptance

- Can scaling become profitable

- Can growth be durable

- The combination of the above is the basis of long-term strong revenue growth

- Two examples of the growth through disruption:

- Netflix – disrupted media industry

- Started as DVD mailing service

- Moved viewing from scheduled programming to watch any time, what you want

- Netflix is growing at a multiple of the industry

- Mercado Libre – Latin American retail disrupting the local industry

-

- Original brick-and-mortar retailer

- Now largest online store in Latin America

- Large addressable market – population of 500 million and GDP of 5 trillion USD

- Durability of growth secured by innovation – 76% of items delivered in 48 hours

- Growth through disrupting new segments – for example, financial services in Brazil

- Growth through disrupting new segments – Advertising

- Growing strongly with Growing margins

-

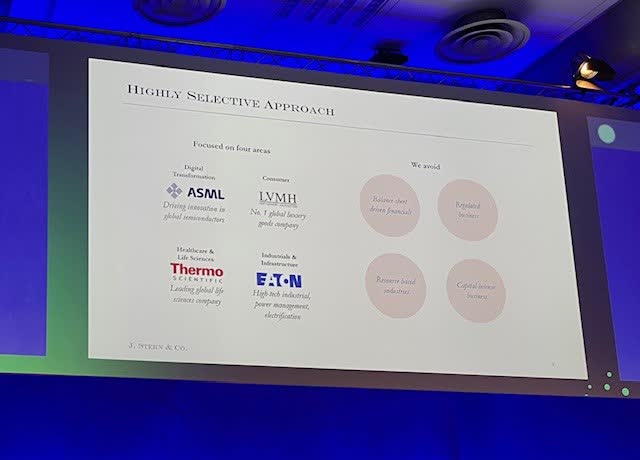

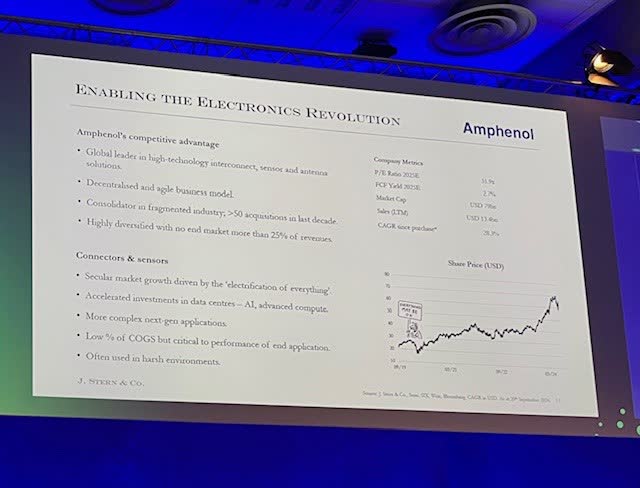

Christopher Rossbach of J.Stern and Co

Quality in Technology.

Christopher is a co-founder and CIO of a London-based private investment partnership focused on high-quality mega-cap global stocks with $2 billion under management.

- We focus on companies with

- Strong, Sustainable competitive position

- Good growing industry

- Management with a track record of value creation

- Financial strength to weather adversity

- J. Stern sees great value in consumer stocks

- J. Stern is focused on four areas

- Amphenol – world leader in connectors, US listed, market capitalization of 80 billion USD

- ASML – Monopoly producer of machines for semiconductor production

- Acquired only in the first quarter of 2023

- The beneficiary in reshoring of semiconductor production – the return of the production to developed markets to limit global geopolitical risks

- Significant backlog of orders

Laure Negiar of Comgest.

Negiar joined the Comgest Global Equities team in 2010. The firm is Paris-based and is employee-owned. Its 50 employee shareholders are asked to borrow to fund their stake in the firm. Laure presented her positions in Eli Lilly and Analog Devices:

- Eli Lilly – global pharmaceutical giant

- original thesis was based on its strong position in insulin – focused on improved margins from its leading position

- Later, the thesis changed – first, margins improved, and then obesity changed the game

- Analog devices – a global leader in analogue devices

- High barrier of entry – too expensive to enter

- Big customers – Auto and Industrials

- Highly cyclical

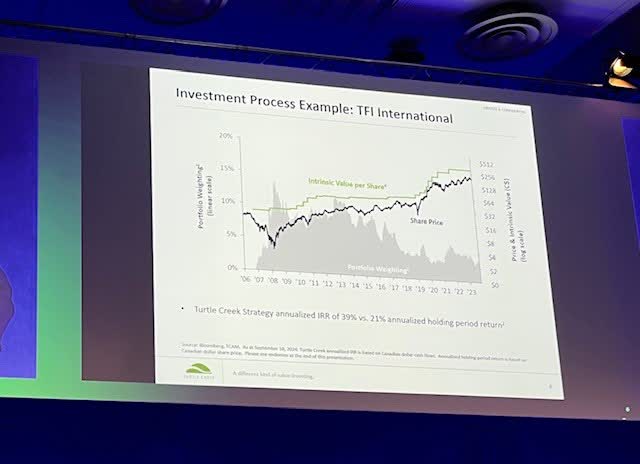

Andrew Breton of Turtle Creek Asset Management

Do not just buy and hold

Breton is the CEO of the Canadian investment manager with 5 billion USD under management, a value investor with a 22% compounded return since 1998.

- We hold companies for a long period. Our shareholding fluctuates.

- Buy and hold is an inferior strategy to buy and optimize

- If you own a company, you need to react to fluctuating share price

- We increase our positions if the value gap proposition increases and reduce if that decreases

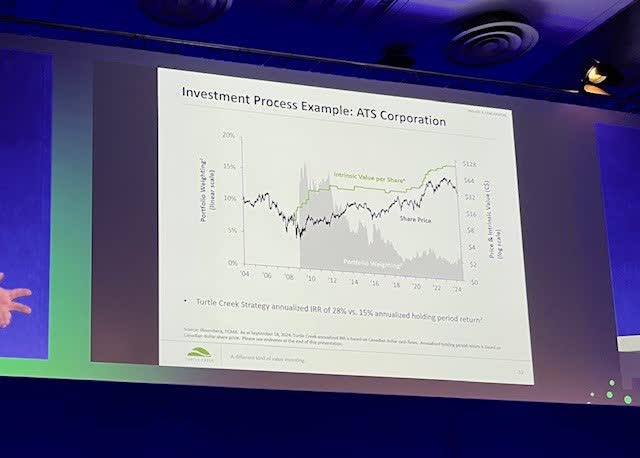

- Two examples of Turtle Creek’s strategy:

- TFI International

- Canada’s largest trucking company, 5th in North America, with a $12 billion market capitalization

- Over 200 acquisitions deploying 6.5 billion USD

- We bought in 2009, and the share price was going down. We were buying more. When the share price appreciated close to our intrinsic value, we were decreasing.

- Buy and hold return would be 21% if you buy and optimize; our IRR was 39%

- TFI expensive now

- ATS Corportaion

- A Canadian company active in global automation has a market capitalization of 3.6 billion USD and is listed on the Toronto Stock Exchange.

- It’s cheap today. The company has massive contracts with GM, but the contracts have slowed down, resulting in share price weakness.

- Buy and hold strategy would result in a 15% annual return vs our 28% in buy and optimize

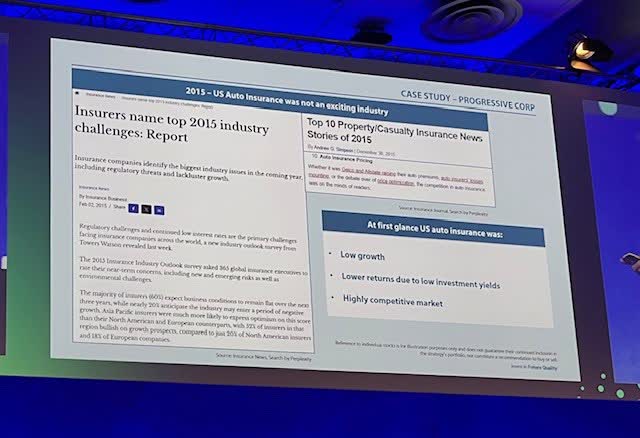

William Low of Nikko Asset Management

Seeing further in Changing Years.

Low joined the Nikko AM Global Equity Team ten years ago. He has been in asset management for 37 years.

-

- We focus on real cash flow to investment CFROI

- We invest in companies that can improve returns and over-perform

- Average companies have 6% CFROI; we aim to invest in top 10% of companies on a CFROI basis with CFROI above 16%

- High margin of safety through strong balance sheet and valuation support

- Examples of our investments:

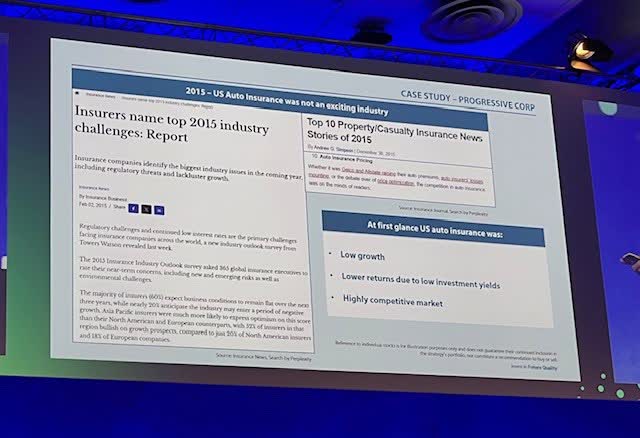

- Progressive Corporation – Better use of data resulted in superior growth

- Polamar – US mid-cap specialized insurer

- Compass Group – a leading catering global company

Steven Yiu of Blue Whale Capital

Yiu is the Lead Manager in Blue Whale, a long-only global fund focused on large-cap stocks in developed markets. The firm has 1.5 billion USD under management.

– We look for Megatrends – focus on digital transformation

- Technology is now 40% of the funds; we are looking for other megatrends too

- During the 2020 pandemic – we bought digital transformation

- In 2022, we exited the majority of the names from the slides

- We invested in Nvidia

- A list of current Megatrends and his investments is below

- META – has the most data about consumers – they know more about us than anybody; with AI, there will be more personalized advertisements. Meta should benefit strongly from AI-targeted advertising.

- We believe Meta is the most promising of the Magnificent 7

- We do not know which megatrend from our slide will be as dominant as AI, but we would like to be exposed to them

- We have exposure to the semiconductor industry through Land Research and Applied Materials – we are believers in a megatrend in silicon sovereignty, we are trying to be exposed to derisking from Taiwan to the Western world

- AI has caused 20% to be in semis – it is growing strongly, and we believe this will continue

Fireside chat with James Anderson – Lingotto Investment Management

Anderson was a partner at Baillie Gifford from 1987 to 2022. He lead their flagship fund until his departure. Anderson is considered one of Europe’s most successful investors.

- The stock market has historically been dominated by a small number of winners.

- Seventy companies have created almost all value creation since 1995. The concentration of value creation increases with time

- One should focus on trying to find these biggest winners

- There are common characteristics of these winners, and these are characteristics are predictable

- More complex than finding the right companies is to stick with them when they have challenges

- AI – people still underestimate how big the winning companies can be

- AI is not about cheating on student essays; AI will help us to resolve the issues we face today in human biology and many other areas.

- We will see ten trillion dollar company in the foreseeable future – within five years.

- AI – robotics will be a critical area of new technology development. We need to wait to see who is likely to be dominant in this area and invest very heavily in it.

- Climate tech is exciting. Most companies in this space are still in private hands.

- Europe is lacking in innovations.

- Chinese companies like BYD are no more subsidized than their European peers. However, BYD had to fight through a much tougher environment than its European peers. Their dominance comes from 30 years of innovation and investing.

- The most difficult part of the investment profession is remaining loyal to the companies we invest in. We often leave investments too early.

- We are now much less invested in China and I am sad about it. Your upside in the individual companies must be weighed against the risk of losing everything due to geopolitical tensions.

- Most climate tech companies are still private companies. We are bullish on that theme.

- We are increasingly focusing on large, successful companies – there is a higher chance they can successfully execute the plant.

- I would be focused on healthcare and biotechnology — this sector is most affected by the financial industry’s short-termism. I would invest 75% of my capital in this sector.

Disclosure:

The goal of the blog is to provide investment ideas for further research. I/we have a beneficial position in the shares discussed above either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. The article does not represent investment advice. Please do your own research before making any investment action.