Sveafastigher, a leading Swedish residential owner, placed its IPO with Friday as the first day of trading. The book was multiple times oversubscribed, but the stock is still trading around the IPO price. We bought in the IPO and bought more in the open market. We like the story.

- Sveafastigher, ticket SVEAF, is the largest residential owner listed in Sweden with 8 bln market capitalization and a free float of around 50%.

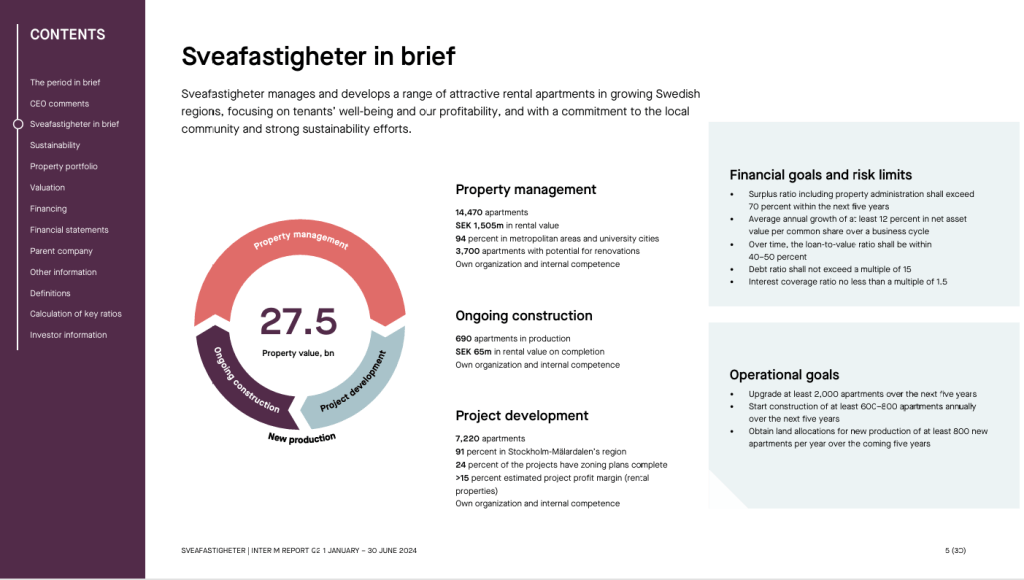

- Sveafastigher owns 14 470 apartments; 690 additional ones are in construction, and 7 200 is in development.

- It trades at a P/NAV of around 0.5 vs its Residential Peer Average of 0.77. That means a 54% upside to re-rate to the average.

- There are strong arguments that SVEAF should trade at a premium – it has growth (through new apartment construction and through the remodelling of part of its existing portfolio), and both are in progress.

- The deal was well allocated. The top 20 investors got almost 70% of the SEK 3.5 billion of capital raised. Many investors got very low allocations. Our allocation was only 10% of our subscription. Investors who got small allocations sold those in the market. That caused the share price volatility. We were buyers.

- There will be several potential catalysts during the next few weeks:

- Release of shareholder list – I hear strong names bought into the IPO. If correct, this should increase investor confidence and initiate price recovery.

- Publication of initiation research by the syndicate brokers – the research can be published 30 days after the IPO. There may be five research initiations by the end of the year.

- 3rd quarter will be reported on 27 November. So, most likely, we get an intitation report before that and then updates based on the first quarter reported as a public company.

- Decreasing interest rates should help the real estate sector.

- Results of the rent price increase negotiation – Sweden is a rent-regulated market. Associations of homeowners with associations of tenants negotiate rent price increases. The talks are ongoing and may be concluded this or next quarter.

- SVEAF should also be included in the index. Peer inclusion drove share prices by 10% in the past. It should happen towards the end of 2025.

- Completing the newly constructed apartments and the remodelling projects should drive the revenue further, which should help the stock re-rate.

Link to latest investor presentation:

1 JANUARY – 30 JUNE 2024 (mfn.se)

Disclosure:

The goal of the blog is to provide investment ideas for further research. I/we have a beneficial position in the shares discussed above either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. The article does not represent investment advice. Please do your own research before making any investment action.