Valeura Energy Inc. (VLERF): A Unique Investment Opportunity

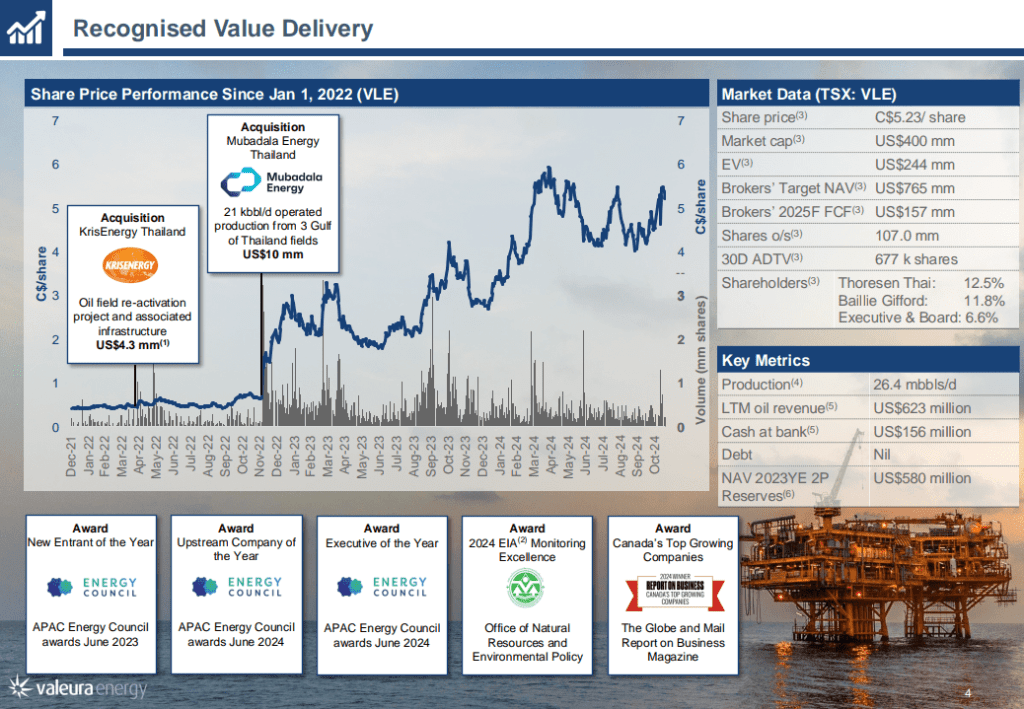

Valeura Energy, a Canadian oil producer with a significant presence in Southeast Asia, presents a compelling investment case. Despite having a market capitalization of $400 million, the company boasts $156 million in cash reserves, no debt, and generates $200 million in annual free cash flow (FCF).

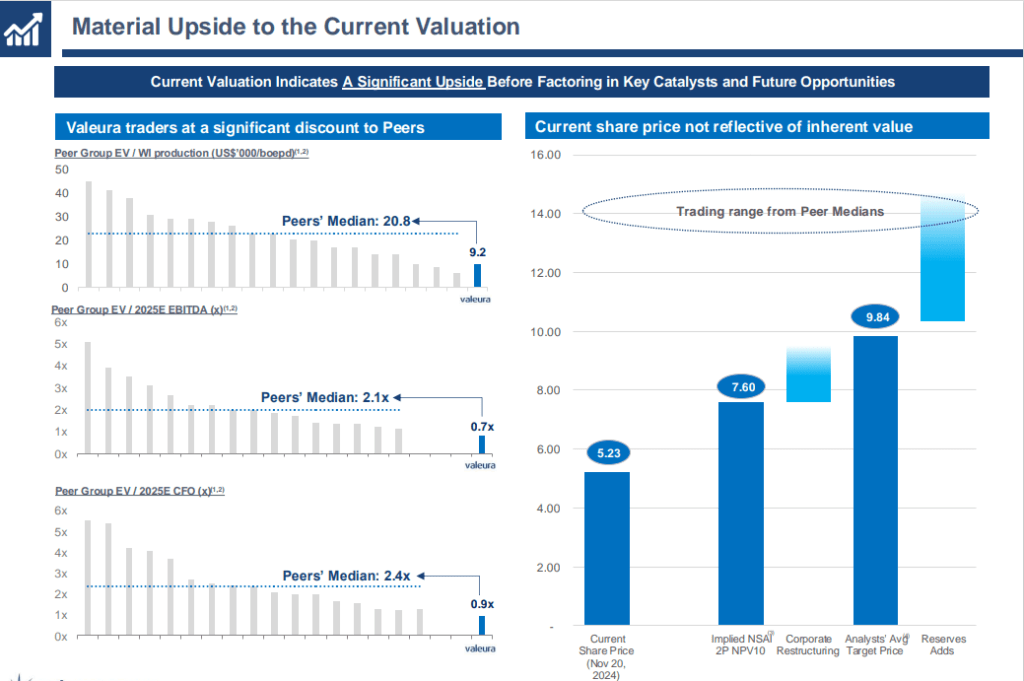

The company’s recent strategic moves and operational efficiency have led to remarkable share price growth, yet Valeura’s valuation remains attractive. Shares trade at just two times FCF and an enterprise value-to-EBITDA (EV/EBITDA) ratio of 0.8, underscoring a significant discount compared to industry peers.

Strategic Acquisitions Drive Growth

Initially focused on oil exploration in Turkey, Valeura’s transformation has been driven by two major acquisitions in 2022 and 2023. These deals have turned $30 million in cash reserves into a market capitalization of $400 million.

In addition to expanding production capacity, Valeura leveraged $400 million in acquired tax-deductible losses to enhance its financial efficiency. The restructuring ensures that three of its four production assets benefit from these tax advantages, creating an estimated net tax saving of $200 million over several years.

Operational Highlights

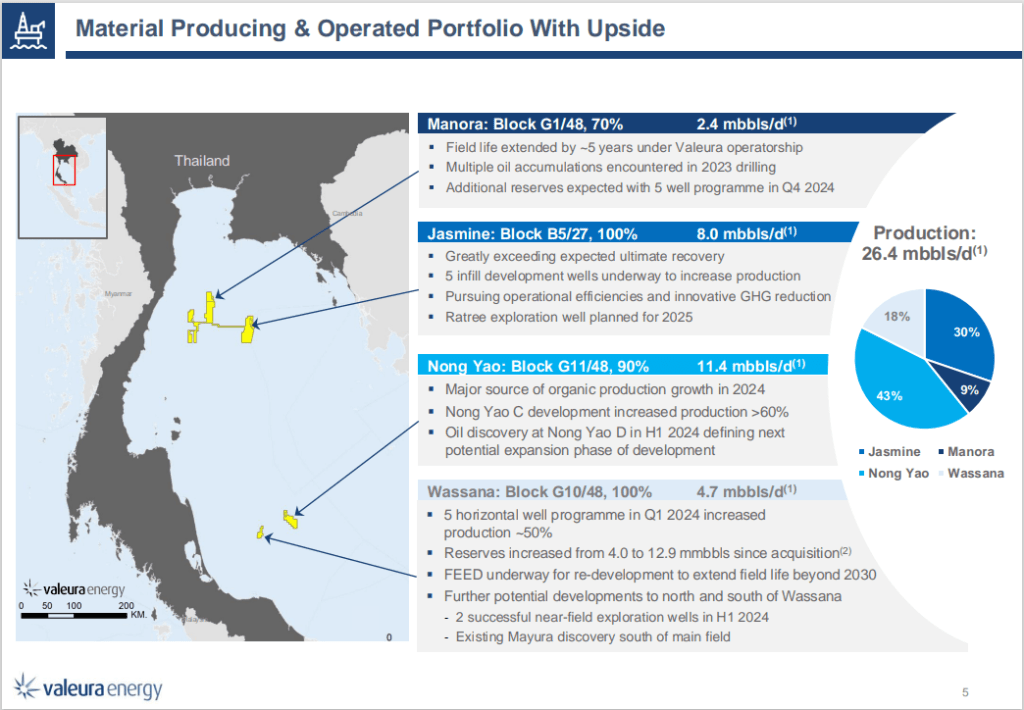

Producing Assets in the Gulf of Thailand

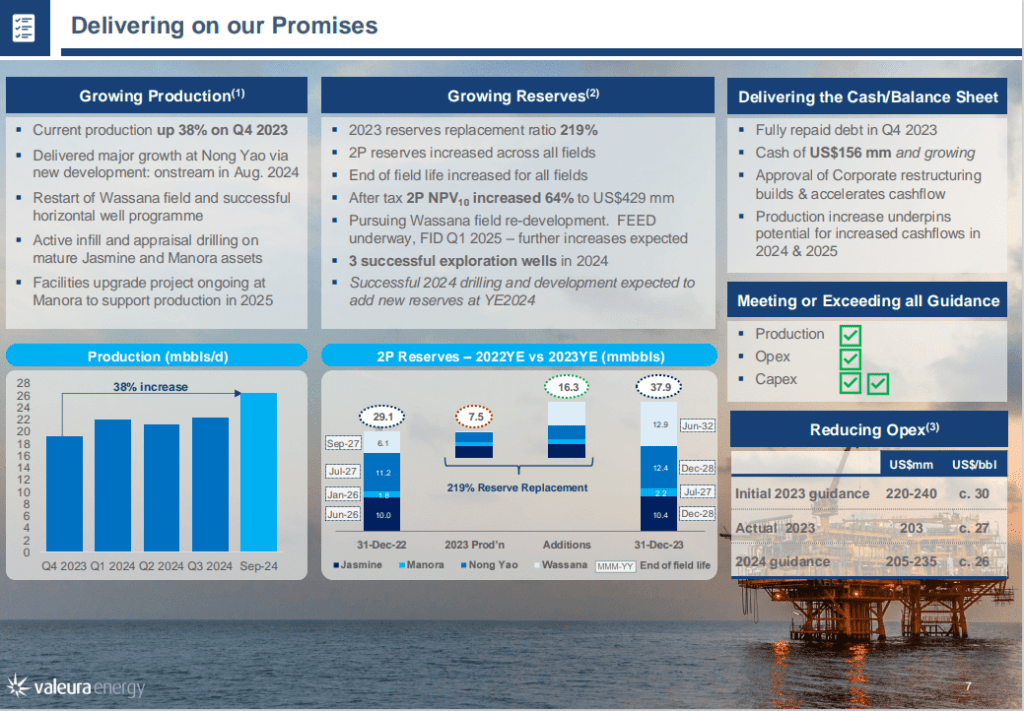

Valeura operates four production assets in the Gulf of Thailand, a region known for its established oil infrastructure and low-cost operations. With an average production of 26,400 barrels per day (BPD), the company generated over $620 million in revenue last year.

Production growth has been impressive, increasing by 38% year-over-year, while proven and probable (2P) reserves grew by 31%. This success is bolstered by a high drilling success rate of approximately 95%, ensuring consistent reserve replacement and long-term production stability.

Financial Strength and Acquisition Potential

Valeura’s strong financial position enables it to pursue additional acquisitions. With a net cash position expected to exceed its market capitalization by the end of 2025, the company is well-positioned for future growth.

Management has indicated interest in acquiring additional assets, particularly as major oil companies divest smaller assets in Southeast Asia. With limited competition in the region, Valeura is poised to secure valuable assets at favorable prices.

Valuation and Shareholder Returns

Despite a tenfold increase in its share price over the last few years, Valeura remains significantly undervalued. The stock, currently trading at C$5.20, has a price target of C$9.20, representing nearly 80% upside potential.

Management’s alignment with shareholders—holding a 6.6% stake—further supports investor confidence. Additionally, the company’s recently announced share buyback program is expected to enhance shareholder returns.

Catalysts for Growth

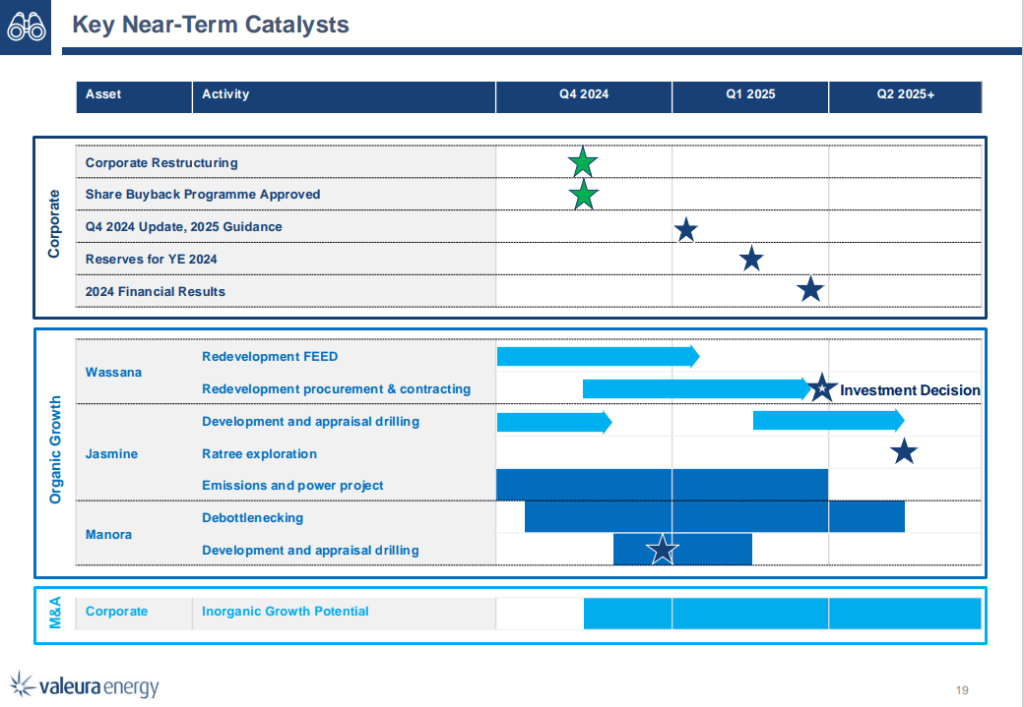

Valeura has multiple catalysts that could drive its valuation higher, including:

- Updated cash balance and 2025 financial guidance (expected in early 2025).

- Development progress at the Wassana field (late Q1 2025).

- Ongoing operational updates and potential acquisitions.

Conclusion

Valeura Energy stands out as a well-managed company with a strong balance sheet, robust cash flow, and proven operational expertise. The strategic acquisitions that propelled its past success position it well for future growth.

As the company continues to execute on its strategy, Valeura’s stock appears poised for significant upside. Investors seeking undervalued opportunities in the energy sector may find Valeura to be a compelling choice.

Disclosure:

The goal of the blog is to provide investment ideas for further research. I/we have a beneficial position in the shares discussed above either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. The article does not represent investment advice. Please do your own research before making any investment action.