NorAm Drilling, US based onshore rig company, reported its numbers.

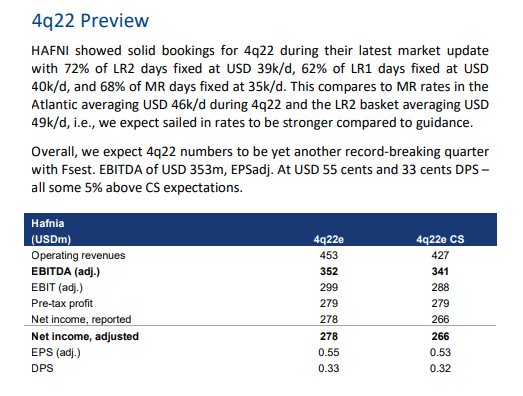

Fearnley main points:

- Rig fleet utilization came in strong at 99.3%

- Cash position ahead of estimates, implying higher dividend potential

- Company trades at an annualized dividend yield of 21%. Dividends paid monthly

FCF came in at a strong USD 6.3m due to higher CFFO, resulting in a net cash position of USD 13m. This beats our USD 11m estimate, implying higher dividend potential. With the NOK 1.05/sh dividend announced in the February update, the company trades at an annualized dividend yield of 21%. We expect to make only minor changes to our estimates and reiterate our Buy recommendation.

On the outlook side, the company is seeing a strengthening in dayrates into the early part of 2023. Moreover, the company commented on the apparent increased near-term risk given low gas prices impacting gas plays like Eagle Ford and Haynesville. However, we argue longer term outlook looks robust, expecting gas prices to recover as we move closer to summer.

The company will host a conference call today at 15:00 CET – link on their www.

Arctic Securities Comment:

NorAm drilling reported Q4/22 revenues of USD 29.5m (In-line with FactSet consensus at USD 29.3m, +11% q-o-q) and adj. EBITDA of USD 11.8m (+5% vs. consensus, +39% q-o-q), driven by higher utilization (99.3% in Q4/22 vs. 98.9% in Q3/22) and average base dayrates, increasing to USD 28,100/day, up 11% from Q3/22. Moreover, the current revenue backlog decreased from USD 52.2m as of November 21, 2022, to USD 31.2m, as of February 20, 2023; however, NorAm expects to add more backlog reflecting higher dayrates based on ongoing contract renewal discussions. In terms of the company outlook, NorAm expects continued solid demand for its high-end “super spec” drilling rigs; however, as natural gas prices have declined, E&P operators could reduce their near-term drilling plans, which would likely result in land rigs being released in gas plays, increasing the available supply.

Pareto comments:

NORAM – Q4 figures very much in line

- Noram Drilling reported an adj. EBITDA of USD 11.8m in Q4, very much in line

with our USD 12m estimate (~1% below) - The EBITDA figure has been adjusted for a USD 0.4m expense related to noncash stock options that are accounted for in the diluted share count we use for

our valuation - Aside from a positive surprise related to other financial income of USD ~2m

(one-off interest and FX gain related to the equity raise during the quarter) and

a somewhat higher working capital build (USD 2m higher than our estimate)

that counteracted the financial income there were no surprises in the report

and NIBD/FCF came in pretty much spot on our expectation - The equity is currently priced at a run-rate dividend yield of ~21% and we have

a BUY rating and TP of USD 7 (NOK ~72)

Broker Price Targets

- Current share price is 61 NOK

- Fearnley has a price target of 70 NOK

- Pareto has a price target of 72 NOK

Disclosure:

The goal of the blog is to provide investment ideas for further research. I/we have a beneficial position in the shares discussed above either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. The article does not represent investment advice. Please do your own research before making any investment action.