The Nordea analyst likes the business, he likes the industry, but is disappointed by the constant over-promise and not deliver story. We all do, and we all are experiencing the resulting pain.

I spoke to the analyst Elliott Jones many times. While he was at Fearnleys he was very bullish on QFUEL. If you read the Nordea report, he still is. At the same time he is puzzled by constant over-promises. And he is puzzled by the recent capital raise. (Please see my previous post on QFUEL for my understanding of the reasons for the timing of the recent capital increase).

Strangely, the front page summary is much more harsh than the whole report. I copy below some quotes from the report that in my view give a good summary of the report (bold emphasis added):

“Although the elegant nature of its proposed chemical recycling technology in combination with sorting and mechanical recycling assets is impressive, the company has repeatedly missed its technological proof of concept targets, which troubles us.”

“We are troubled by its track record of not meeting targets, as evidenced by capex multiple times higher than the initial guidance for Skive, which was originally due to commence operations in Q1 2020.”

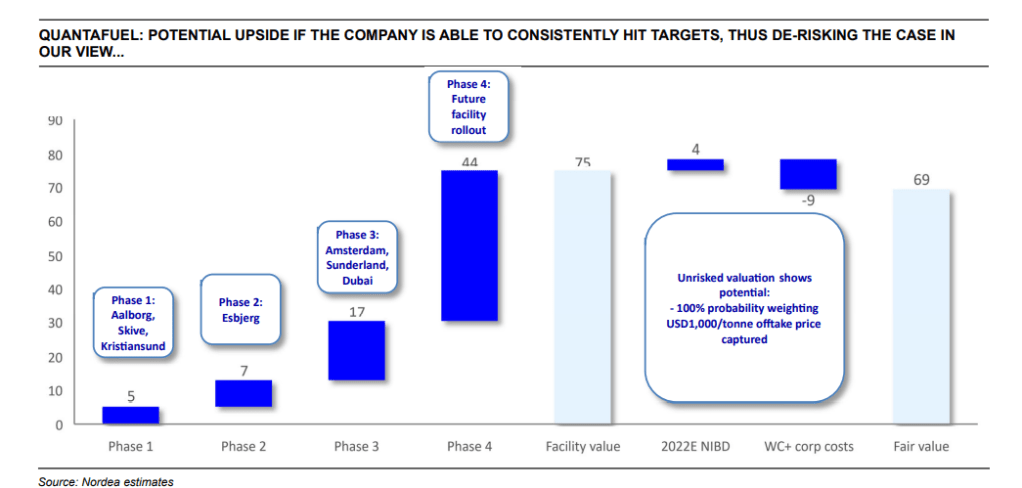

“We base our valuation methodology on deriving cash flows for each Quantafuel facility mentioned in our envisaged rollout in the above section. We assume a WACC of 8% (in line with our choice of WACC for other chemical recyclers we cover). In the next step, we feel it necessary to risk the discounted cash flows of each phase (the first phase being the facilities in construction, the second phase being projects announced and the third phase being the future rollout).

The first reason for this is that we want to take into account the risks going forward that come with an early-stage company in a nascent industry. The second reason, however, is that the company has in the past missed several deadlines/milestones (for example, first oil and proof of concept at Skive, capex at Skive, etc.). While we fully understand that there have been several good reasons for this, we believe it is fair and sensible to further risk the company’s value to account for potential misses in deadlines in the future. As a result of this, we assign a 90% probability to the current facilities (Skive, Aalborg, Kristiansund), a 70% probability to Esbjerg sorting (higher than chemical given recent company commentary), a 60% probability to Esbjerg chemical, 40% to Amsterdam, Sunderland and Dubai and 25% to the future facilities.”

“What do we need to see for us to change our minds?

As mentioned, we believe Quantafuel is targeting a very elegant solution to the issue of waste plastic, involving post-pyrolysis purification as well as combining chemical recycling with sorting and mechanical recycling facilities to obtain the highest possible recycling rate. Given this, we note that if the company is able to reach proof of technological concept and hit company-guided targets, we see an increasingly de-risked case – to this point, if we model 100% probability for all phases and include an offtake price in line with company guidance (USD 1,000/tonne), a fair value of almost NOK 70 per share is achieved.“

Our Summary

In summary the analyst brings down the DCF by putting probability discounts on the company projects. For example he gives Skive, Kristianslund and Aalborg 90% probability of success, Esbjerg 60-70% and all other mega projects 25%-40%. I view as a positive that he sees the Skive, Kristianslund, and Aalborg as 90% chance of success. I believe this is in many investors the prime risk. I believe if they can put Skive in operation, achieve Proof of Concept and achieve their 2022 guidance, than the further growth will follow. QFUEL will become the leader of plastic recycling. It is therefore encouraging that Elliott gives that 90% success probability.

I think that his 25%-40% chance on other projects is a bit contra-intuitive – if he believes that Skive has 90% chance of succeeding, than I think it makes very likely that at least some other projects will happen as well. Discounting all of them by 60%-75% might be too harsh.

The report is much more bullish than the front page summary suggest. In fact, if QFUEL suddenly now reported PoC, which will turn the investment case sunny and promising again, Elliott could publish a very bullish report with a 70NOK TP, and use 90% of this report without changing it much.

His main point remains valid. “If the company can get it right and consistently hit deadlines, we see high potential (more than twice current share price levels)…” At the graph above his current valuation of QFUEL achieving its targets is 69NOK, if Quantafuel starts delivering. We are on board with that.

Disclosure:

The goal of the blog is to provide investment ideas for further research. I/we have a beneficial position in the shares discussed above either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. The article does not represent investment advice. Please do your own research before making any investment action.