Summary

- Africa Oil owns a 6% stake in the Venus discovery, the 8th largest discovery made in the 21st century.

- TotalEnergies is the largest investor and operator of Venus. Total calls Venus “Golden Block”. Total is spending 50% of its global exploration budget on Venus.

- Retail investors speculated on Venus’s size disclosure during Total’s Capital Market Day through Africa Oil shares, causing a 30% drop in its share price. That made the opportunity more attractive.

- The second Venus well results are expected to be published by the end of November. That should further certify Venus’s size and push the Africa Oil stock up.

Introduction to Africa Oil

Africa Oil Corp (TSX:AOI:CA) (OTCPK:AOIFF) is an upstream oil corporation that was founded in 1988 and headquartered in Vancouver, Canada. Its core lies in exploration assets located in the nascent and under-explored terrains of West and East Africa.

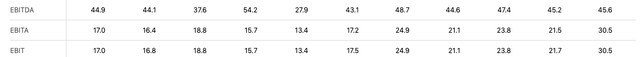

Africa Oil is listed in Toronto (TOR: AOI) and Stockholm (STO: AOI). The market capitalization is CAD 1.2 billion (USD 850 million). The 2023 Revenues, EBITDA, and Net Profit are estimated at USD 300 million, USD 270 million, and USD 210 million, respectively. The company has a year-end 2023 projected Net Cash position of around USD 200 million.

Africa Oil’s strategic capital allocation and disciplined financial management have helped maintain a strong balance sheet, enabling it to weather the volatile phases of the oil industry.

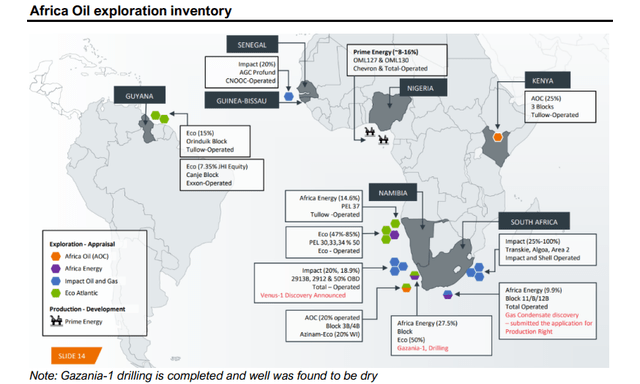

Africa Oil owns two operating assets, two major oil discoveries, and several prospective resources:

Operating Assets

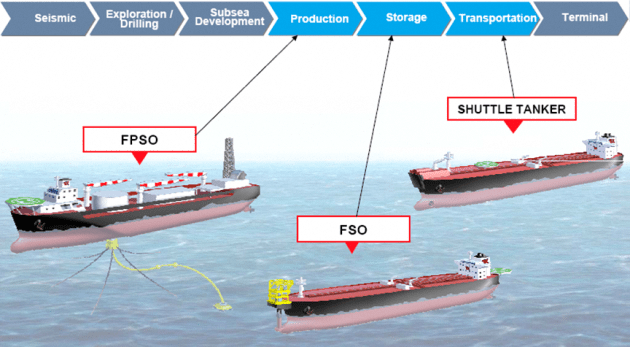

Africa Oil owns 3 of the top 5 oil-producing fields in West Africa through its 50% stake in Prime:

- Agbami field (OML 127) is operated by Chevron (CVX), and Africa Oil owns an indirect 4% stake.

- Egina, Akpo (OML 130) is operated by TotalEnergies (TTE), and Africa Oil owns an indirect 8% stake.

Both production assets are in Nigeria. The company has a long-lived production base of 20,000 bbl/day net to AOI with very low operating costs of around USD8/bbl.

The three producing assets generated Net Revenues to AOI of USD 138 million and USD 300 million in 2022 and projected 2023. respectively.

Prime Track Record

The three West African oil-producing wells illustrate greatly AOI capabilities:

- AOI bought a 50% stake in Prime in January 2020 for USD 520 million.

- In three years, AOI collected USD 713 million in dividends from Prime.

- If oil would remain at USD 70 per bbl, AOI should receive at least USD 150 million in dividends from Prime over the next three years. With oil at current prices, the annual dividend would be significantly higher.

I believe it could be a great investment with strong cash flows coming for the years to come.

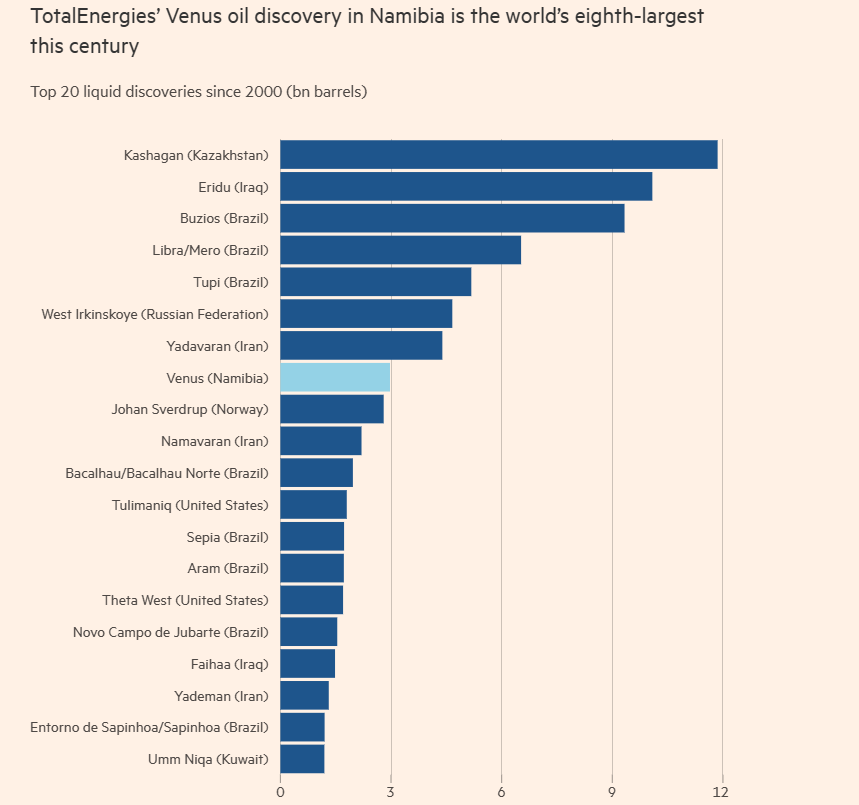

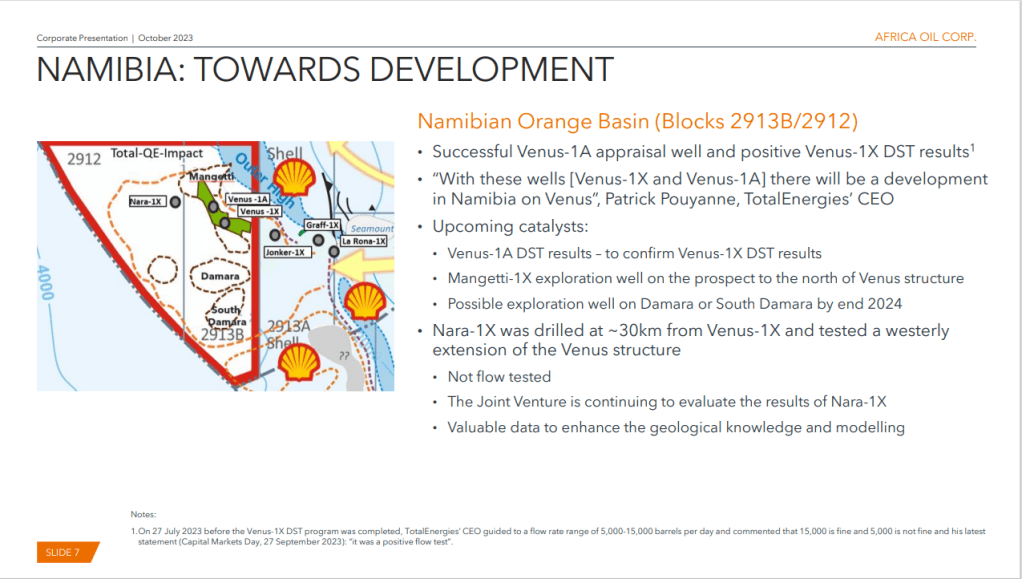

Discoveries – Venus of the Century

Africa Oil holds a 6.2% indirect stake in the Venus discovery offshore Namibia through its 31% stake in Impact Oil and Gas. The operator of the discovery is Total, which owns a 40% stake (other owners are Qatar (30%), Impact (20%), and Namcor (10%)). Total has mooted Venus as a “Golden Block” and will spend this year more than 50% of its global exploration budget to apprise Venus. Venus is very material for Total and even more material for AOI. The Financial Times reported Venus as the eighth-largest discovery in this century, bigger than Johan Sverdrup, Europe’s largest producing field.

The other important discovery in the AOI Portfolio is Preowei, which is part of OML130 that AOI owns indirectly through Prime. Preowei deposit may increase production of the OML130 by 50%, which is material for AOI. Just for comparison, AOI’s stake in Venus may contain at least 25 times more oil than AOI’s stake in Preowei.

Significant Development and Exploration Upside

Africa Oil has an additional portfolio of development and exploration assets, split between direct interests and indirect interests through its portfolio companies. The slide below summarizes the opportunities.

Another material asset that could drive the share price is Block 11B/12B. AOI owns an indirect 3% stake (through its 30% stake in Africa Energy) in the block, which is also operated by TotalEnergies. Total has applied for a production license that should be issued early next year. Total is also negotiating an off-take agreement with the nearby power plant owned by Eskom. Achieving those targets should drive the AOI stake in Africa Energy materially higher.

Production assets and Venus represent most of the value of Africa Energy. In the next few weeks, the AOI share price will likely be mainly driven by the Venus news flow.

The Opportunity – Share Price Down on Speculation by Retail Investors

- During 2023, Total hyped Venus. Total used very strong statements on Venus’s size. See the FT article for an illustration.

- The market expected that Total would use its well-advertised Capital Markets Day on 27 September to provide details on Venus’s size. Many retail investors speculated on this through shares of AOI.

- The speculation did not work out. Total did not publish any material update on the Venus size on Capital Markets Day.

- Total only stated that Venus will proceed to commercialization, and the deposit estimate size is at least 1-2 billion barrels. They also announced that Nara, an adjacent plot to Venus, showed a non-commercial deposit of oil.

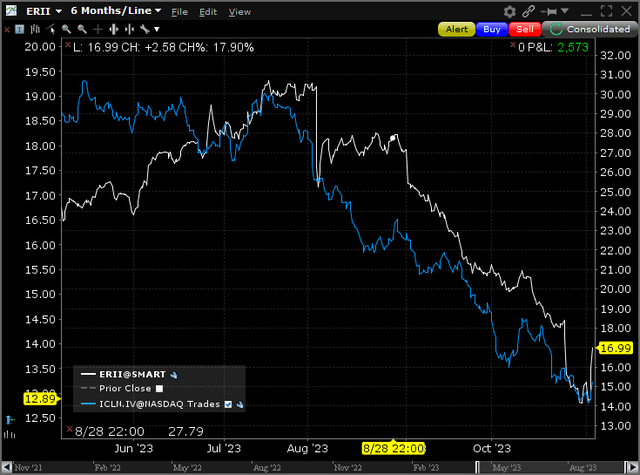

- Total communication drove AOI share price down by 30%.

- This creates the opportunity – the stock was pushed down while strong catalysts on Venus are due by the end of November.

- Total is drilling a second well in Venus. The flow data that should reconfirm the Venus size should be published by the end of November. That should re-rate the AOI share price in my view.

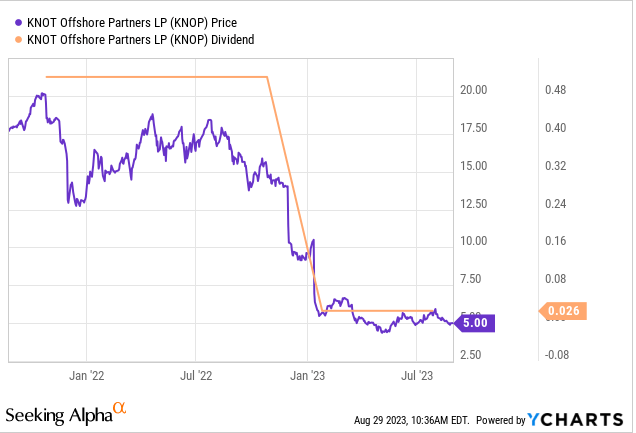

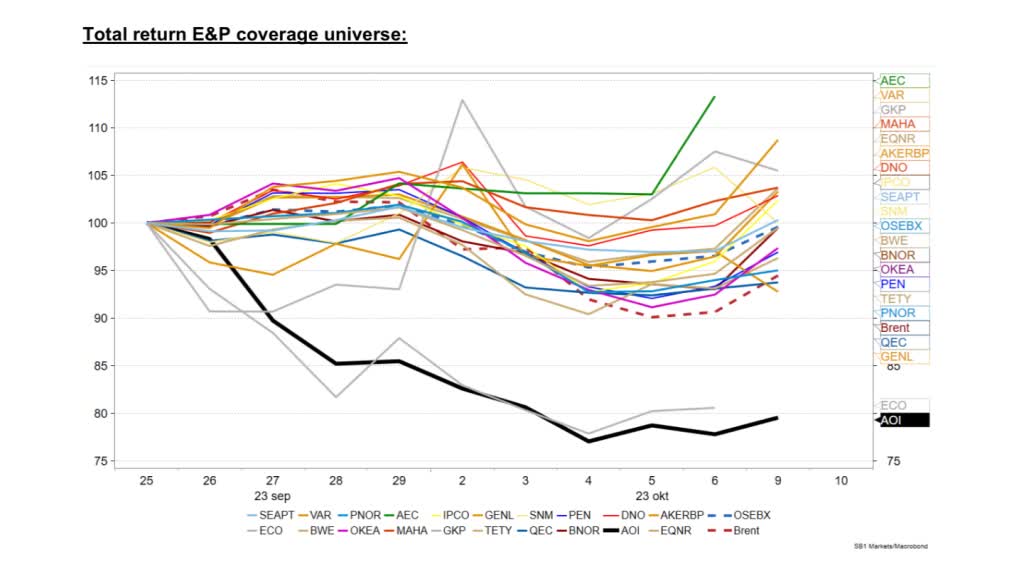

Total’s Capital Markets Day Drove AOI 30% down and made AOI the worst-performing Scandi Oil stock.

Source: Sparebank Research

Why did Total not Publish the Data?

- I believe Total’s cheering up the deposit in the press was unusual. Conventional practice is to limit disclosure for deposits set for production in about five years.

- There are speculations suggesting that Impact Oil may sell its 20% stake in Venus. AOI holds a 31% stake in Impact Oil.

- Total might be an interested party to buy Impact’s stake in Venus.

- If they would not buy, they would at least prefer to have a say in who the buyer is in my opinion. Total has, therefore, a low incentive to help prospective buyers be attracted by robust flow data.

- Qatar could be an ideal buyer; they are a strategic long-term player. They may be less price-driven. Qatar is mainly working with Total – they are together in Namibia, South Africa, and Guyana.

Venus Massive Field’s Potential

- Total declared Venus will be developed.

- Total’s conservative estimate places Venus at 1-2 billion barrels. That is a very conservative assessment, according to AOI.

- Wood Mackenzie’s report from 3rd October 2023 highlights Venus with a potential of 4.4 billion barrels boe (3 billion oil + 1.4 billion gas), assuming a conservative 30% oil recovery.

- The flow data disclosed by the end of November should help to fine-tune the size of the deposits. It will be the major catalyst for the stock.

Further Upside in Adjacent Fields to Venus:

- Nara: Found to contain oil, though not at commercial levels. Total contemplates further drilling in the Nara block. Nara still has a promising potential.

- Mangetti: Situated above Venus, current drilling results are expected by February 2024.

- Damara and South Damara show encouraging seismic results, with drilling planned for 2024.

Valuation – Venus and other discoveries are given no value by the market

The recent sell-off brought the current AOI share price to 21 SEK (2.71 CAD). I looked at how Scandinavian broker houses value AOI´s two oil-producing assets:

- SpareBank Research values AOI´s two oil-producing assets at 19 SEK

- Pareto Securities values AOI´s two oil-producing assets at 17 SEK (assuming USD 70 per bbl, every USD 10 increase in assumed oil price would add 20% to the valuation)

- Arctic Securities values the two oil-producing assets at SEK 22 SEK.

In summary, after the sell-off, the AOI is valued approximately at the valuation of its oil-producing assets. All discoveries and all prospective assets are, at the moment, not reflected in Africa Oil’s share price.

Venus, which FT calls the 8th largest discovery of this century and which Total calls a “Golden Block”, is not reflected in the Africa Oil share price at all.

The Venus valuation is hard to assess. The valuation is driven by Venus Recoverable volumes and assumed oil price.

To give an indication, Arctic Securities produced a valuation matrix with the above two variables. For example, at Venus’ size of 3 bln barrels and with an assumed oil price of USD 80 per barrel, the AOI’s stake in Venus would be valued at USD 800 million. That is well above the current AOI’s enterprise value of USD 650 million.

Catalysts

- Venus’s results will drive the AOI’s share price in the near term.

- The second well results, expected by the end of November, might spark a material share price rebound.

- The major catalyst would be the sale of an AOI stake in Venus to Qatar or a similar investor. The transaction value is hard to assess but could easily beat the whole AOI Enterprise value in my view.

- Africa Oil has a 30% stake in Africa Energy, which is the owner of a 10% stake in Block 11B/12B, a major gas liquids deposit in South Africa. Rumors suggest the operator Total is close to sealing an off-take agreement with Eskom.

Conclusion

Africa oil is down 30% in the last few weeks. In the short term, the share price will most likely be driven by Venus’s news flow. The second well results from Venus should be available by the end of November and should re-rate the stock.

The potential sale of AOI’s stake in Venus would be game-changing for Africa Energy and its shareholders.

Total is spending 50% of its exploration budget this year on Venus. I think Total believes in Venus. Investors should at least study the opportunity.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure:

The goal of the blog is to provide investment ideas for further research. I/we have a beneficial position in the shares discussed above either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. The article does not represent investment advice. Please do your own research before making any investment action.